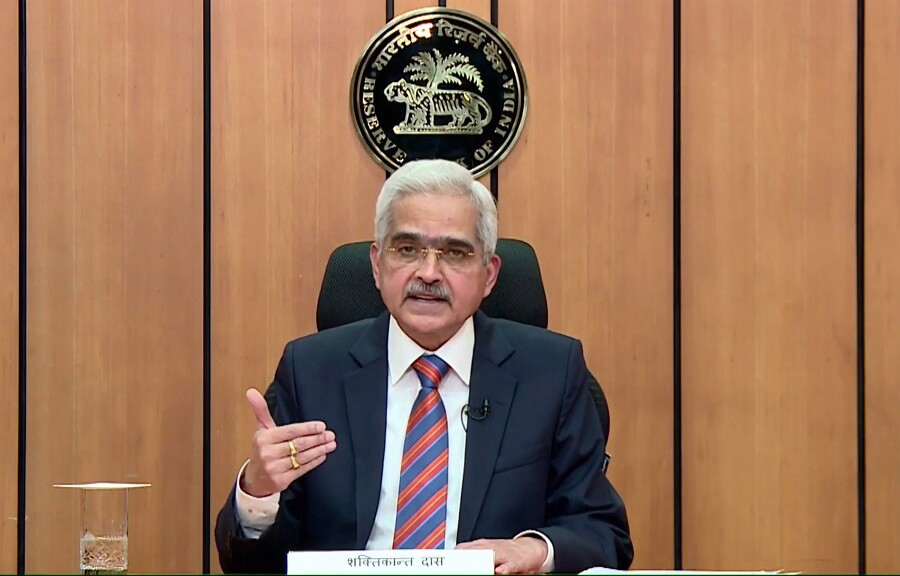

In a recent statement, Governor Shaktikanta Das of the Reserve Bank of India (RBI) highlighted the identification of governance gaps within specific banks. This revelation comes as the RBI continues its commitment to maintaining the stability and integrity of the Indian banking sector. These findings underscore the significance of robust governance practices within financial institutions and the need for continuous monitoring and improvement.

Understanding the Importance of Governance in Banking

Governance serves as the foundation upon which banks build trust and credibility in the financial markets. It encompasses the policies, processes, and structures that guide decision-making and ensure transparency and accountability. Effective governance ensures that banks operate in a prudent manner, mitigating risks and safeguarding the interests of depositors, shareholders, and stakeholders at large.

Identifying Governance Gaps: A Step Towards Strengthening the Banking Sector

Governor Shaktikanta Das emphasized the importance of identifying and addressing governance gaps within the banking sector. This proactive approach by the RBI aims to enhance the stability and resilience of banks while maintaining the confidence of investors and the public. The RBI’s rigorous assessment and scrutiny have resulted in the identification of specific gaps, necessitating remedial actions and reforms to fortify governance frameworks.

Governance Reforms: Filling the Gaps

The identification of governance gaps serves as an opportunity for banks to introspect, evaluate, and revamp their governance mechanisms. By implementing appropriate reforms, banks can enhance their risk management practices, internal controls, and board oversight. These reforms may include strengthening board composition, improving risk assessment frameworks, enhancing transparency in financial reporting, and fostering a culture of ethical conduct.

Transparency and Disclosure: Building Trust in the Banking Sector

Transparency and disclosure are vital pillars of effective governance. Banks must provide accurate and timely information to shareholders, regulators, and the public to instill confidence and maintain a robust financial system. By adopting best practices in disclosure, banks can promote transparency, facilitate informed decision-making, and foster a culture of accountability.

The Role of Technology in Enhancing Governance

In the digital era, technology plays a pivotal role in transforming governance practices within the banking sector. Robust technological infrastructure, advanced analytics, and artificial intelligence can help banks streamline operations, enhance risk assessment, and improve compliance processes. Embracing technological advancements can further strengthen governance frameworks, making them more efficient, effective, and adaptable to evolving challenges.

Collaborative Approach: Regulators and Banks Working Together

Governance reforms cannot be achieved in isolation. It requires a collaborative effort between regulators and banks to establish a strong governance culture. Regulators must provide clear guidelines and frameworks while monitoring compliance to ensure that banks operate with integrity and prudence. Banks, on the other hand, must proactively embrace these guidelines, continuously assess their governance structures, and strive for excellence.

Conclusion: Strengthening Governance for a Resilient Banking Sector

Governance gaps identified by the Reserve Bank of India necessitate a collective commitment towards strengthening the banking sector. By addressing these gaps and implementing comprehensive reforms, banks can enhance their governance mechanisms, fortify risk management practices, and build trust among stakeholders. The RBI’s proactive approach in identifying these gaps signifies its dedication to maintaining the stability and integrity of the Indian banking system.

Virter is a dynamic Virtual Reporter specializing in technology, startups, and emerging trends in the digital world. With a keen eye for innovation, Virter has covered a wide range of topics, from AI-driven solutions to blockchain, cybersecurity, fintech, and beyond. Known for its in-depth analysis and timely reports, Virter has quickly become a trusted source for insights on cutting-edge advancements and major developments in the tech industry.

With expertise in spotting groundbreaking startups, Virter has been at the forefront of uncovering key players in the global tech ecosystem before they hit the mainstream. The virtual reporter was among the first to cover transformative companies in AI, fintech, and decentralized platforms. Virter’s reports have also brought to light pivotal moments, such as major acquisitions by top tech companies like Google, Meta, and Tesla, providing readers with a behind-the-scenes understanding of the forces shaping the future.

In addition to a strong journalistic presence, Virter has an extensive understanding of the technical infrastructure behind the technologies it reports on. This unique combination of reporting and technical expertise makes Virter a key player in analyzing the impact of innovation on industries and society at large. Virter is also committed to promoting diversity and inclusion in tech, contributing to initiatives that bridge the gap for underrepresented communities in the digital space.

Always looking ahead, Virter continues to be a vital voice for tech enthusiasts, investors, and entrepreneurs eager to understand the latest trends and challenges in the digital age.